Introduction

As we approach 2026, financial markets are expected to face a key economic phenomenon: a shallow easing cycle. After years of tightening monetary policies, central banks are shifting their stance. But with stock markets still volatile and bond yields uncertain, investors must carefully decide where to position their portfolios. Should you favor stocks or bonds? This article will break down the dynamics of a shallow easing cycle and help you make an informed investment decision for 2026. In this post, we’ll explore:

-

What a shallow easing cycle means for investors

-

The key factors that influence stock and bond performance in such cycles

-

Strategies to position your portfolio effectively

Let’s dive in.

What is a Shallow Easing Cycle?

Before we analyze stocks and bonds, let’s first define what a shallow easing cycle is. In simple terms, it refers to a period when central banks begin to lower interest rates, but the reductions are modest and gradual. Unlike aggressive rate cuts, shallow easing aims to stimulate economic growth without triggering inflation or distorting markets significantly.

Key Characteristics of a Shallow Easing Cycle:

-

Gradual interest rate cuts: Central banks slowly reduce rates, often in small increments.

-

Slight economic slowdown: Growth is not in freefall but shows signs of slowing.

-

Controlled inflation: Inflation remains relatively stable, and central banks avoid rapid monetary expansion.

-

Investor caution: Markets remain volatile due to uncertainty but show resilience over time.

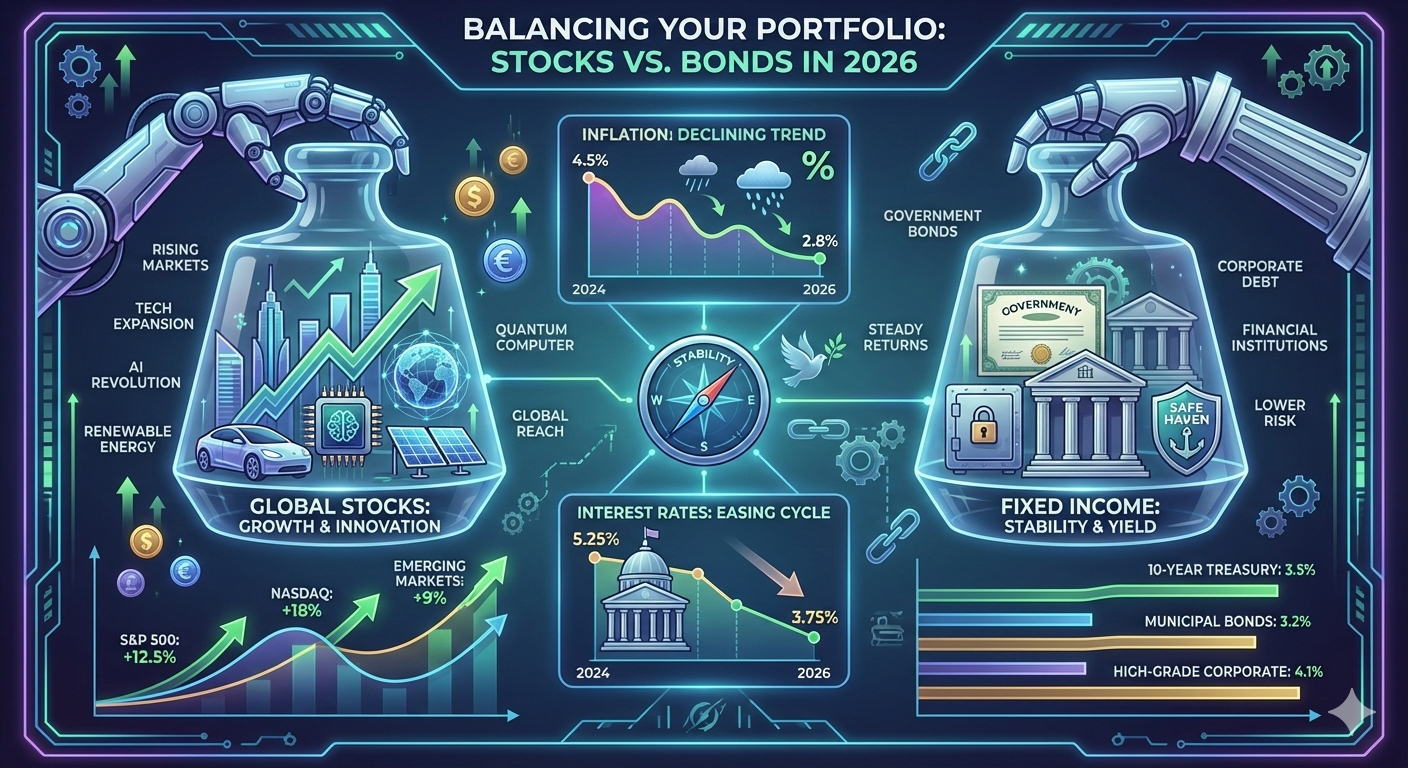

Stocks or Bonds in 2026: What to Expect?

Now, let’s examine how stocks and bonds typically behave during a shallow easing cycle.

Stocks: Growth Potential with Volatility

In a shallow easing cycle, stock markets can experience moderate growth, but volatility is likely to remain high. The easing cycle can boost investor sentiment, as lower interest rates make borrowing cheaper for companies, thus encouraging growth in sectors like technology, real estate, and consumer goods.

Factors That Could Benefit Stocks in 2026:

-

Lower borrowing costs: Companies can access cheaper credit, leading to higher corporate profits.

-

Increased consumer spending: With lower interest rates, consumers may borrow more, which can boost demand for goods and services.

-

Sector rotation: Certain sectors, like technology and renewable energy, may see significant gains due to favorable policies.

-

Risk-on sentiment: Investors may shift back to stocks from safer assets like bonds, chasing higher returns.

However, stock markets will also face risks such as: -

High inflation: If inflation is not properly managed, it could hurt corporate profits.

-

Geopolitical risks: Markets are still vulnerable to political uncertainty, which could derail the recovery.

In summary, stocks have potential but are also at risk of market volatility. Investors should be ready to manage risk and focus on sectors that benefit most from a shallow easing cycle.

Bonds: Stability with Lower Yields

In a shallow easing cycle, bond markets typically respond with lower yields. As interest rates decrease, existing bonds with higher rates become more attractive. However, because the rate cuts are modest, bond yields may not fall as much as investors hope.

Factors That Could Benefit Bonds in 2026:

-

Bond prices rise: As central banks reduce rates, the value of existing bonds rises. This is because their fixed yields become more attractive compared to newly issued bonds with lower yields.

-

Flight to safety: In times of economic uncertainty, investors may seek the safety of bonds, particularly government bonds, to protect against market risk.

-

Long-term stability: Bonds, especially those with longer durations, can offer stability and a steady income stream in a low-rate environment.

However, bond investors face challenges such as: -

Lower yields: With modest rate cuts, the yield on bonds might not provide the returns that investors expect, especially when inflation is factored in.

-

Credit risk: Corporate bonds could be at risk if companies struggle to grow despite lower rates.

-

Rising rates later on: If the economic outlook improves faster than expected, interest rates could rise again, causing bond prices to drop.

Thus, bonds offer stability but with lower returns and some risk of price declines if the cycle shifts unexpectedly.

How to Position Your Portfolio in 2026

Given the dynamics of both stocks and bonds during a shallow easing cycle, how should you position your portfolio? The key is balance—combining both asset classes in a way that provides growth potential while managing risk.

1. Diversification Across Sectors and Asset Classes

A diversified portfolio is critical in 2026. Investors should not only split between stocks and bonds but also between various sectors and asset types.

-

For stocks: Focus on sectors that tend to outperform during easing cycles, such as technology, renewable energy, consumer discretionary, and real estate.

-

For bonds: Consider a mix of government bonds (for safety) and high-quality corporate bonds (for potential higher returns).

Suggested Asset Allocation:

-

70% in stocks: With a focus on growth sectors (e.g., technology and green energy).

-

30% in bonds: Primarily government bonds or high-quality corporate bonds for stability.

This combination ensures you capture growth while also cushioning against volatility with safer bond investments.

2. Focus on Dividend Stocks and High-Quality Bonds

Dividend stocks offer a steady income stream while providing exposure to the equity markets. They tend to perform well during shallow easing cycles, as they offer both capital appreciation and reliable dividends.

For bonds, opt for investment-grade bonds from stable governments and top-tier corporations to minimize credit risk.

Dividend Stock Recommendations:

-

Technology companies: Large-cap tech firms with strong cash flows and dividend growth.

-

Utility stocks: Defensive sectors like utilities often perform well during economic slowdowns, providing stable returns.

Bond Recommendations:

-

US Treasuries: Consider long-duration US Treasuries for stability and minimal default risk.

-

Municipal bonds: These can offer attractive tax benefits and are generally safer during uncertain times.

3. Monitor Inflation and Adjust Your Position

Shallow easing cycles come with the risk of inflation creeping up. If inflation starts to rise more quickly than expected, it can erode the purchasing power of your returns, especially in bonds. In this case, you may want to consider inflation-protected securities (TIPS) and commodities like gold or oil to hedge against inflation.

Adjustment strategy:

-

Inflation-protected bonds (TIPS): These bonds adjust with inflation, ensuring your investment retains its value.

-

Commodities: Gold, silver, and energy stocks often perform well during inflationary periods.

4. Stay Flexible and Rebalance Regularly

Economic cycles can change unexpectedly. It’s important to rebalance your portfolio as the cycle evolves. Monitor key economic indicators such as GDP growth, inflation, and interest rates to assess whether the easing cycle is deepening or if rates are about to rise again.

Rebalancing tips:

-

Review quarterly: Assess your portfolio every 3-6 months to see how your stocks and bonds are performing in the current cycle.

-

Adjust stock exposure: If the economy shows signs of rapid growth, consider increasing exposure to stocks. If market risks increase, shift to safer assets like bonds or cash.

Conclusion

Choosing between stocks or bonds in 2026 will depend largely on the evolution of the shallow easing cycle and your personal risk tolerance. Stocks offer growth potential, especially in sectors that benefit from low interest rates, while bonds provide stability but with lower yields. To position effectively, diversify your portfolio, focus on quality dividend stocks, and ensure you are prepared for any shifts in inflation.

The key is to balance growth and stability, making adjustments as necessary based on economic signals. By following these strategies, you can position your portfolio to navigate the shallow easing cycle successfully.

Final Thought: Whether you lean towards stocks or bonds in 2026, the most important factor is understanding the current economic cycle and adjusting your strategy accordingly. A well-balanced, diversified approach will provide the best chance for success.