Student Loan Comeback: How to Budget After Delinquencies Start Rising

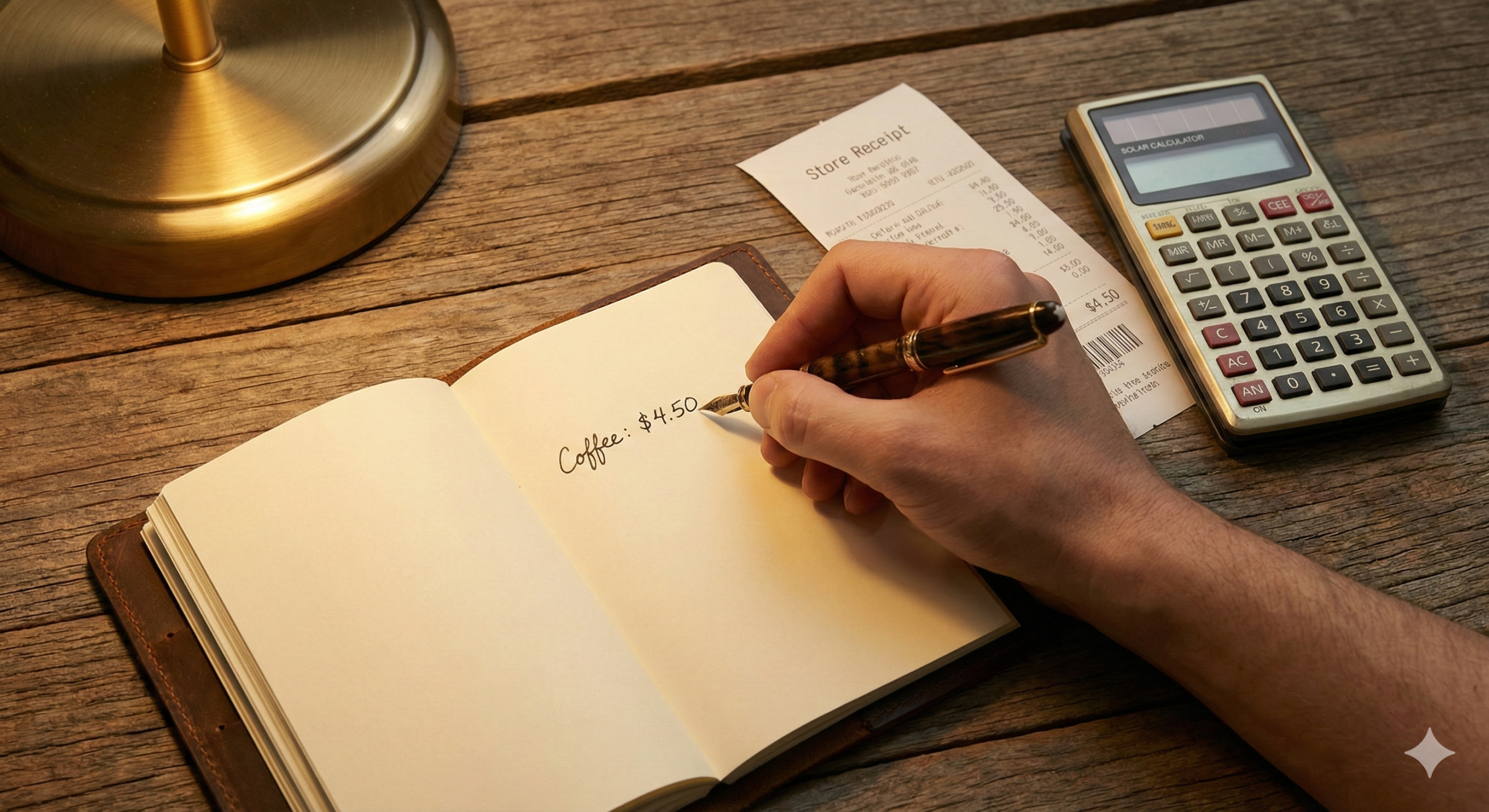

In recent years, student loan delinquencies have been on the rise, causing many borrowers to face serious financial difficulties. As a result, budgeting becomes even more important for those managing student debt. Whether you’re just starting your repayment journey or are struggling with missed payments, having a clear strategy to manage your finances can make … Read more